Exhibit 99.1 OTCQX:BBXIA December 2021

Forward Looking Statements This presentation contains forward-looking statements based largely on current expectations of the BBX Capital and its subsidiaries that involve a number of risks and uncertainties. All opinions, forecasts, projections, future plans, or other statements, other thanstatements of historical fact, are forward-lookingstatements. The forward-lookingstatements in thispresentation are also forward-lookingstatements within the meaning ofSection 27Aof the Securities Act of 1933, as amended (the“SecuritiesAct”), and Section 21E of the Securities Exchange Act of 1934, as amended (the“ExchangeAct”), and involve substantial risks and uncertainties. We can give no assurance that such expectations will prove to be correct. Actual results, performance, or achievements could differ materially from those contemplated, expressed, or implied by the forward-looking statements contained herein. Forward-looking statements are based largely on our expectations and are subject to a number of risks and uncertainties that are subject to change based on factors which are, in many instances, beyond our control. When considering forward-looking statements, the reader should keep in mind the risks, uncertainties, and other cautionary statements made in this presentation and in theCompany’s reports filed with the Securities and Exchange Commission(“SEC”). The reader should not place undue reliance on any forward-looking statement, which speaks only as of the date made. This presentation also contains information regarding the past performance of the Company and its respective investments and operations. The reader should note that prior or current performance is not a guarantee or indication of future performance. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, and all such information should only be viewed as historical data. Future results and the accuracy of forward-looking statements may be affected by various risks and uncertainties, including the residential and commercial real estate industry in which BBXRE develops, operates, manages, and invests in real estate, the home improvement industryin which Renin operates, and the sugar and confectioneryindustryin which BBX Sweet Holdings operates. Risks and uncertainties include risks relating to public health issues, including, in particular, the COVID-19 pandemicand its variants, as itisnot currentlypossible toaccuratelyassess theexpectedduration and effects ofthe pandemic on ourbusiness. These include required closures ofretaillocations,travelandbusinessrestrictions, “shelter inplace” and“stay athome” orders and advisories, volatility in the global and national economies and equity, credit, and commodities markets, worker absenteeism, quarantines, and other health-related restrictions; the duration and severity of the COVID-19 pandemic and the impact on demand for theCompany’s products and services, levels of consumer confidence, supply chains, labor costs and raw materials costs; actions taken by governments, businesses, and individuals in response to the pandemic and their impact on economic activity and consumer spending, which will impact theCompany’s ability to successfully resume full business operations; the pace of recovery when the COVID-19 pandemic subsides and the possibility of a resurgence and/or new variants; competitive conditions; theCompany’s liquidity and the availability of capital; the effects and duration of steps the Company takes in response to the COVID-19 pandemic, including the inability to rehire or replace furloughed employees or retain employees: the impact of the emergence ofIT’SUGAR from the Chapter 11 proceedings, revesting of theCompany’s equity interest inIT’SUGAR and the reconsolidation ofIT’SUGAR’s results into theCompany’s financial statements; the potential adverse impact of the Chapter 11 proceedings and the success of the restructuring; the continuing adverse impact of the COVID-19 pandemic onIT’SUGAR’s operations, results, and financial condition, including with respect to demand, sales levels, and consumer behavior, as well as increased inventory, freight, and labor costs and general supplychain disruptions, have had and maycontinue to have a material adverse effect in future periods; the risk thatIT’SUGAR maynot be able to continue to increase prices without significantly impacting consumer demand and sales volume; risks relating toIT’SUGAR’s business plans, including thatIT’SUGAR may not be able to fund or otherwise open new retail locations, including new“temporary” locations or future new“largeformat” retail locations, as or when expected, or at all; the risk thatIT’SUGAR may not be able to extend or enter into new lease agreements for any existing “temporary” locations which it desires to extend, whether on favorable terms or at all; risks related to the lease amendments entered into byIT’SUGAR, including that, while many of the lease amendments provide for the payment of rent based on a percentage of sales volumes for a specified period of time as opposed to fixed rental payments, the terms of many of such amendments requireIT’SUGAR to resume the payment of previously scheduled fixed lease payments going forward and, as a result,IT’SUGAR’s ongoing occupancy costs are expected to increase as fixed rental payments under these leases resume andIT’SUGAR’s overall exposure to risks related to fixed rental obligations will increase and revert to pre-bankruptcy levels in relation to such locations; the risk that landlords may exercise their right to terminate leases; the inability to predict the effect of IT’SUGAR’s emergence from the bankruptcy proceedings on the Company and its results of operation and financial condition; the risk of heightened litigation as a result of actions taken in response to the COVID-19 pandemic; the impact ofthe COVID-19 pandemic on consumers, including,but not limited to, their income, their level of discretionaryspendingbothduring and after the pandemic, and their views towards the retail industry; the riskthat certain oftheCompany’s operations,includingretailoperations, maynot generate recurringsources ofcashduring or followingthe pandemic tothe extent anticipated or at all;the riskthat commodity, freight, and labor price increases may adversely impact the gross margins of BBX Capital Real Estate, BBX Sweet Holdings, and Renin; the risk that homebuilders will not meet their obligations to acquire lots atBBXRE’s Beacon Lake communitydue to the impact of higher construction costs and supplyshortages of building materials, equipment and appliances; and the risk that the loss of sales of products toRenin’s major customers and/orRenin’s efforts to maintain sales of its products to its major customers may negatively impactRenin’s sales, gross margin, and profitability, require Renin to lower its prices, and result in the recognition of impairment losses related to its goodwill and long-lived assets and noncompliance with the terms of its outstanding credit facility. This presentation also contains a discussion ofRenin’s prior acquisition of substantially all of the assets and assumption of certain of the liabilities of Colonial Elegance, which is subject to the impact of economic, competitive and other factors affecting Renin and Colonial Elegance, including their operations, markets, marketing strategies, products andservices;the riskthat the integration ofColonialElegance maynot be completed asanticipated;that the anticipated expansion or growth opportunities willnotbe achieved orifachievedwillnot be advantageous; that the acquisition will not be cash accretive; that net income maynot be generated when anticipated or at all or the acquisition mayresult in net losses; that BBX Capital and/or Renin maynot realize the anticipated benefits ofthe acquisition when or tothe extent anticipated or at all; and the risks associated with the increased indebtedness incurred byRenin to finance the acquisition including, compliance with financial covenants and restrictions onRenin’s activities. Reference is alsomade to the other risks and uncertainties described in BBXCapital’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, as well as BBXCapital’s Annual Report on Form 10-Kforthe year endedDecember31,2020, which are currentlyavailable on theSEC's website,https://www.sec.gov, and onBBXCapital’swebsite,www.BBXCapital.com. TheCompanycautions thatthe foregoing factorsare notexclusive,andthatthereadershouldnotplace unduereliance onanyforward-looking statement,whichspeaksonlyasofthedatemade. 1

BBX Capital Corporate Strategy BBX Capital, Inc. (OTCQX: BBXIA) (PINK: BBXIB) is a Florida-based diversified holding company whose principal holdings include BBX Capital Real Estate (“BBXRE”), Renin, and BBX Sweet Holdings, which includes IT’SUGAR. Build long-term shareholder value as Goal opposed to focusing on quarterly or annual earnings Achieve long-term growth as measured by Objective increases in book value and intrinsic value over time 2

BBX Capital Executive Team An entrepreneurial team focused on creating value over the long term Jarett Levan Brett Sheppard Seth Wise Alan B. Levan John E. Abdo CEO & President BBXRE Chief Financial Officer Chairman Vice Chairman EVP, President 3

BBX Capital Former Parent Company Affiliates A family of companies dating back nearly 60 years, whose activities have previously included: • Real Estate Acquisition and Management - $1 Billion+ • Banking - 100 Branches, $6.5 Billion in Assets • Commercial Real Estate Lending - $3 Billion+ • Investment Banking & Brokerage - 1,000 Investment Professionals • Homebuilding - Thousands of Homes • Planned Community Development - 10,000+ Acres • Asian Themed Restaurants - 65 Locations • Vacation Ownership Resort Network, including over 65 resorts and access to approximately 11,000 other hotels and resorts worldwide 4

BBX Capital Principal Holdings 1 2 3 5

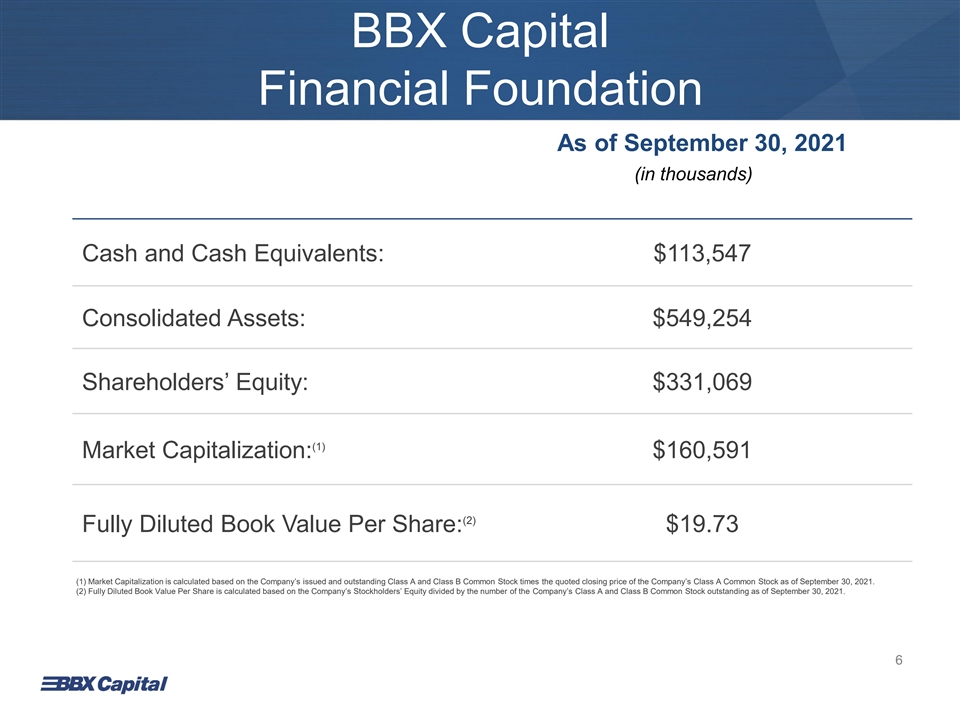

BBX Capital Financial Foundation As of September 30, 2021 (in thousands) Cash and Cash Equivalents: $113,547 Consolidated Assets: $549,254 Shareholders’ Equity: $331,069 (1) Market Capitalization: $160,591 (2) Fully Diluted Book Value Per Share: $19.73 (1) Market Capitalization is calculated based on the Company’s issued and outstanding Class A and Class B Common Stock times the quoted closing price of the Company’s Class A Common Stock as of September 30, 2021. (2) Fully Diluted Book Value Per Share is calculated based on the Company’s Stockholders’ Equity divided by the number of the Company’s Class A and Class B Common Stock outstanding as of September 30, 2021. 6

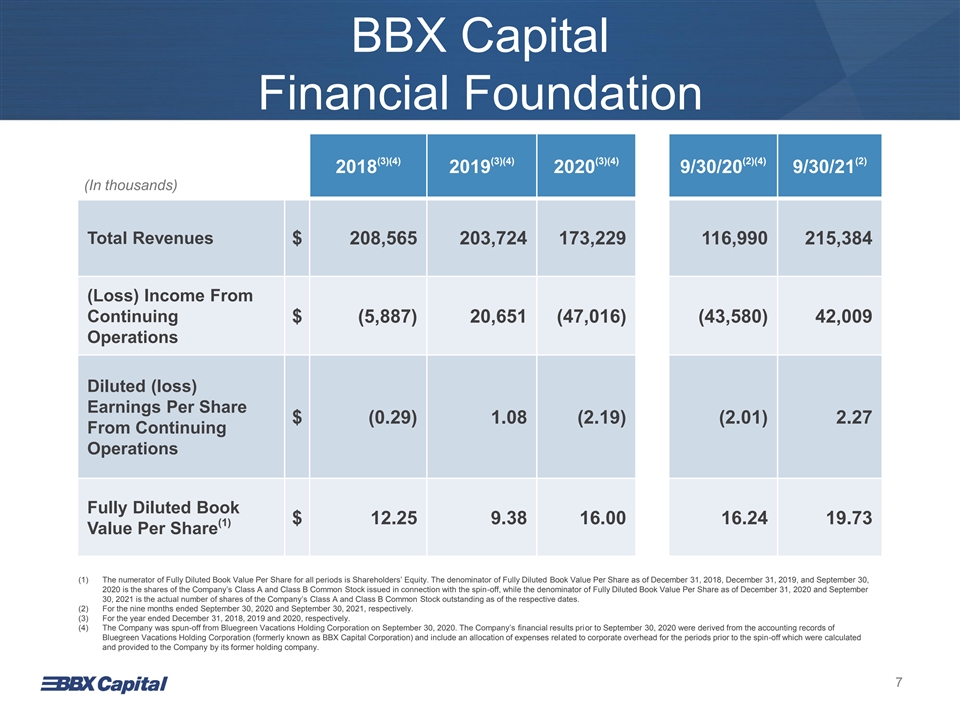

BBX Capital Financial Foundation (3)(4) (3)(4) (3)(4) (2)(4) (2) 2018 2019 2020 9/30/20 9/30/21 (In thousands) Total Revenues $ 208,565 203,724 173,229 116,990 215,384 (Loss) Income From Continuing $ (5,887) 20,651 (47,016) (43,580) 42,009 Operations Diluted (loss) Earnings Per Share $ (0.29) 1.08 (2.19) (2.01) 2.27 From Continuing Operations Fully Diluted Book $ 12.25 9.38 16.00 16.24 19.73 (1) Value Per Share (1) The numerator of Fully Diluted Book Value Per Share for all periods is Shareholders’ Equity. The denominator of Fully Diluted Book Value Per Share as of December 31, 2018, December 31, 2019, and September 30, 2020 is the shares of the Company’s Class A and Class B Common Stock issued in connection with the spin-off, while the denominator of Fully Diluted Book Value Per Share as of December 31, 2020 and September 30, 2021 is the actual number of shares of the Company’s Class A and Class B Common Stock outstanding as of the respective dates. (2) For the nine months ended September 30, 2020 and September 30, 2021, respectively. (3) For the year ended December 31, 2018, 2019 and 2020, respectively. (4) The Company was spun-off from Bluegreen Vacations Holding Corporation on September 30, 2020. The Company’s financial results prior to September 30, 2020 were derived from the accounting records of Bluegreen Vacations Holding Corporation (formerly known as BBX Capital Corporation) and include an allocation of expenses related to corporate overhead for the periods prior to the spin-off which were calculated and provided to the Company by its former holding company. 7

Principal Holdings 2 3 1 • IT’SUGAR • Designer, • Acquisition, • Hoffman’s manufacturer and development, Chocolates distributor of: and management • Las Olas ➢ Sliding doors of real estate and Confections ➢ Door systems investments in and hardware real estate joint ➢ Home décor ventures products 8

BBX Capital Real Estate • BBX Capital Real Estate is engaged in the acquisition, development, construction, ownership, financing, and management of real estate and investments in real estate joint ventures, including investments in multifamily rental apartment communities, single-family master-planned for sale housing communities, industrial and commercial properties located primarily in Florida. In addition, BBX Capital Real Estate owns a 50% equity interest in The Altman Companies, a developer and manager of multifamily rental apartment communities. • In an effort to diversify its portfolio of real estate developments, BBX Capital Real Estate is also currently evaluating potential investment opportunities in industrial real estate assets, including the development of warehouse and logistics facilities, and has expanded its operating platform to include an industrial real estate division. In addition, the Altman Companies is also currently evaluating potential opportunities to develop multifamily rental apartment communities in the greater Atlanta, Georgia area. 9

BBX Capital Real Estate The following describes certain of our current investments in real estate and real estate joint ventures. 10

Acquisition of The Altman Companies Transaction Details ➢ On December 3, 2018, BBX Capital Real Estate acquired a 50% interest in apartment developer The Altman Companies, including interests in Altman Development Company, Altman-Glenewinkel Construction, and the Altman Management Company. ➢ BBX Capital Real Estate has also agreed to acquire an additional 40% interest in The Altman Companies on January 1, 2023 and the remaining 10% in certain circumstances. 11

The Altman Companies The Altman Companies is a real estate development company which operates a fully integrated platform for site selection, underwriting, design, construction, management and sale of apartment communities. Since 1968, The Altman Companies have developed, constructed, acquired and managed more than 25,000 multi-family homes in Florida, Michigan, Illinois, Tennessee, Georgia, Texas and North Carolina. The company is best known for communities rented under its Altís brand. Its real estate and development activities are typically financed through a combination of internal and external equity and institutional debt. 12

Altis Grand Central Altis Grand Central Tampa, Florida • 314 Multifamily Units • Investment Date – Q4 2017 • Status – Recapitalized. BBX received distribution of $7.5M and recognized equity earnings from its investment of $6.2M in 2021 13

Altis Miramar (East / West) Altis Miramar Miramar, Florida • 650 Rental Apartments in two adjacent communities (320 Unit Garden Style/ 330 Unit Mid-Rise) • Construction Loan Closed – Q4 2019 • Status – Under Construction • First delivery of units in Q4 2021 14

Altis Little Havana Altis Little Havana Miami, Florida • 224 Rental Apartments • Construction Loan Closing – Q3 2019 • Status – Under Construction • First delivery of units expected in Q1 2022 15

Altis Ludlam Trail Altis Ludlam Trail Miami, Florida • 312 Rental Apartments • Construction Loan Closed – Q2 2020 • Status – Under Construction • First delivery of units expected in Q1 2022 16

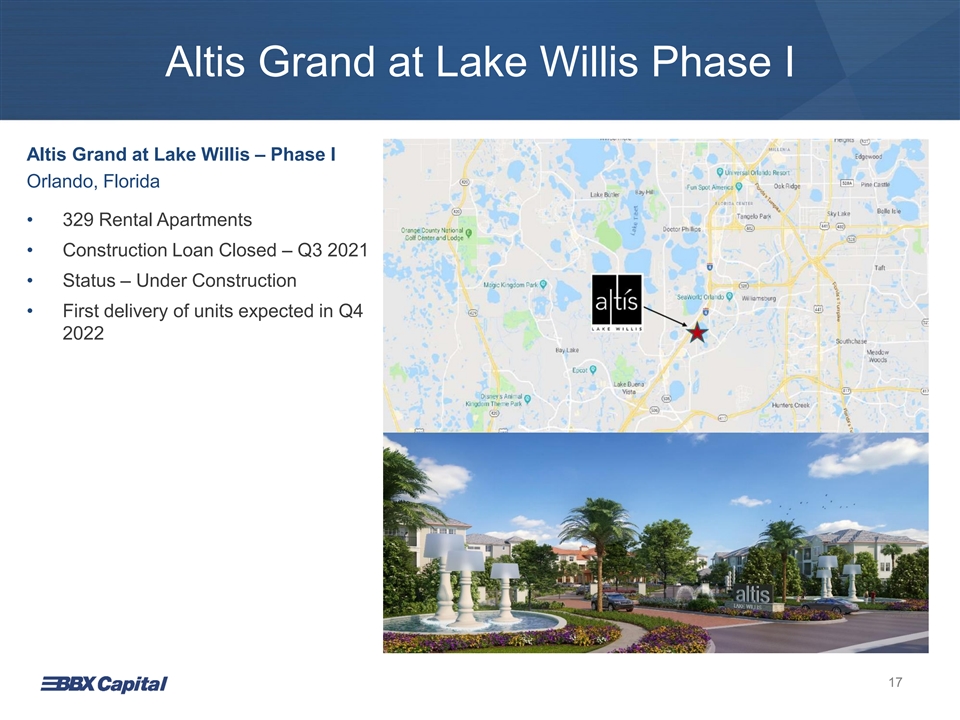

Altis Grand at Lake Willis Phase I Altis Grand at Lake Willis – Phase I Orlando, Florida • 329 Rental Apartments • Construction Loan Closed – Q3 2021 • Status – Under Construction • First delivery of units expected in Q4 2022 17

Altis Grand at The Preserve Altis Grand at The Preserve Tampa, Florida • 350 Multifamily Units • Construction Loan Closed – Q1 2019 • Status – Sold in June 2021 (1) • Realized $4.7M profit and 87% IRR (1) Internal Rate of Return (“IRR”) was determined based upon the actual timing of cash outflows invested by BBX and cash inflows received by BBX throughout the life of the project. 18

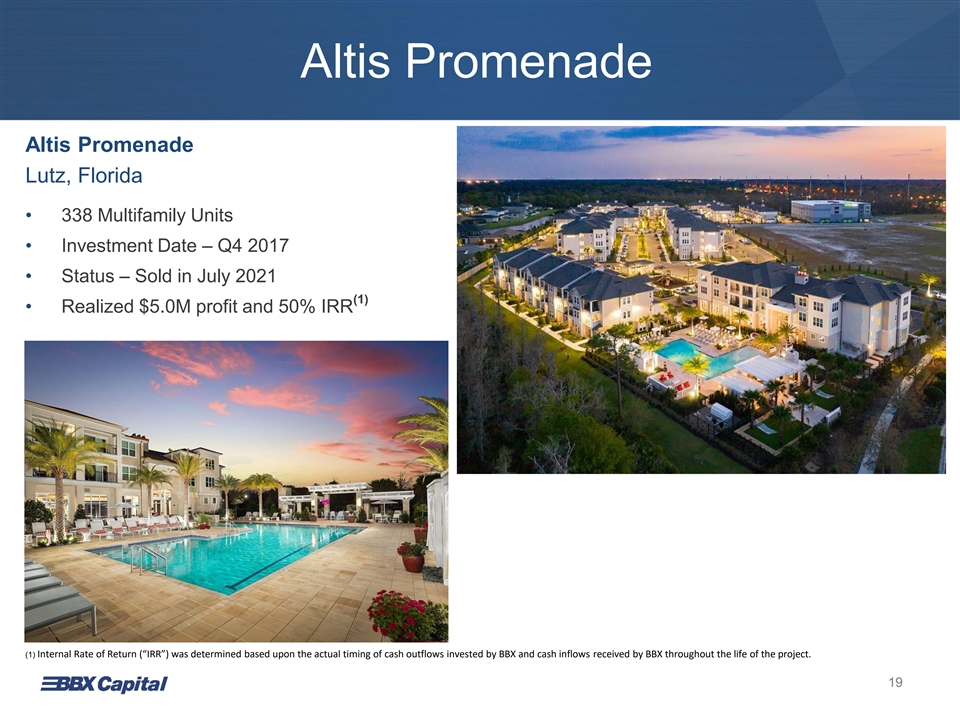

Altis Promenade Altis Promenade Lutz, Florida • 338 Multifamily Units • Investment Date – Q4 2017 • Status – Sold in July 2021 (1) • Realized $5.0M profit and 50% IRR (1) Internal Rate of Return (“IRR”) was determined based upon the actual timing of cash outflows invested by BBX and cash inflows received by BBX throughout the life of the project. 19

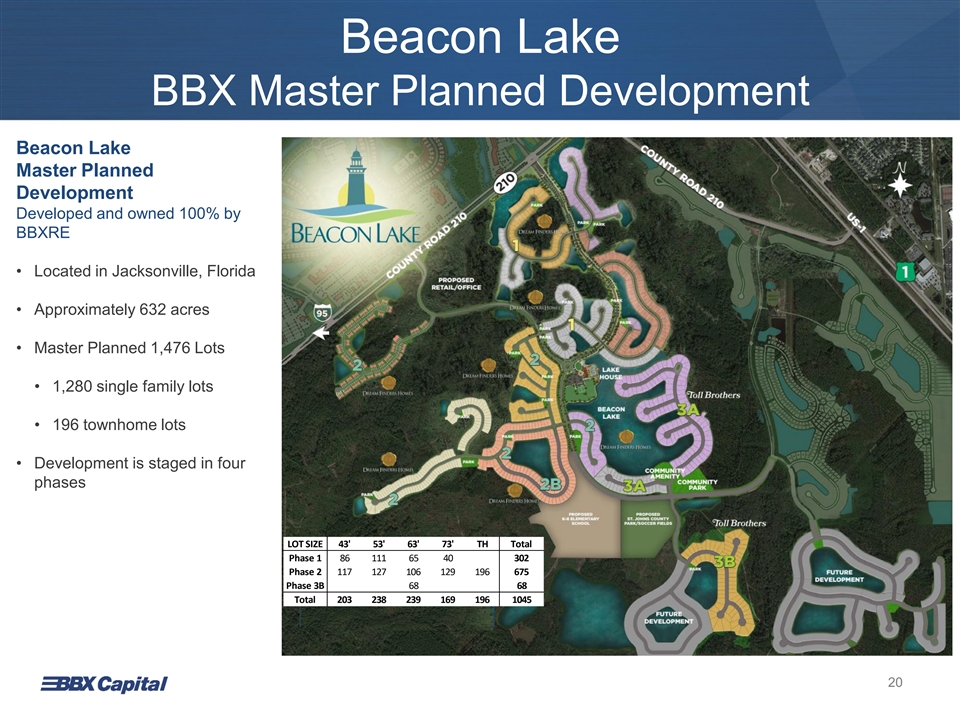

Beacon Lake BBX Master Planned Development Beacon Lake Master Planned Development Developed and owned 100% by BBXRE • Located in Jacksonville, Florida • Approximately 632 acres • Master Planned 1,476 Lots • 1,280 single family lots • 196 townhome lots • Development is staged in four phases LOT SIZE 43' 53' 63' 73' TH Total Phase 1 86 111 65 40 302 Phase 2 117 127 106 129 196 675 Phase 3B 68 68 Total 203 238 239 169 196 1045 20

Beacon Lake Phase I BBX Master Planned Development Beacon Lake – Phase I Master Planned Development Developed and owned 100% by BBXRE • 302 Lots • 151 Lots sold to Dream Finders Homes • 151 Lots sold to Mattamy Homes • 302 Lots taken down by Builders • 301 Homes owned by homebuyers as of 09/30/21 • Entry feature and 8,200 SF Amenity Center is completed 21

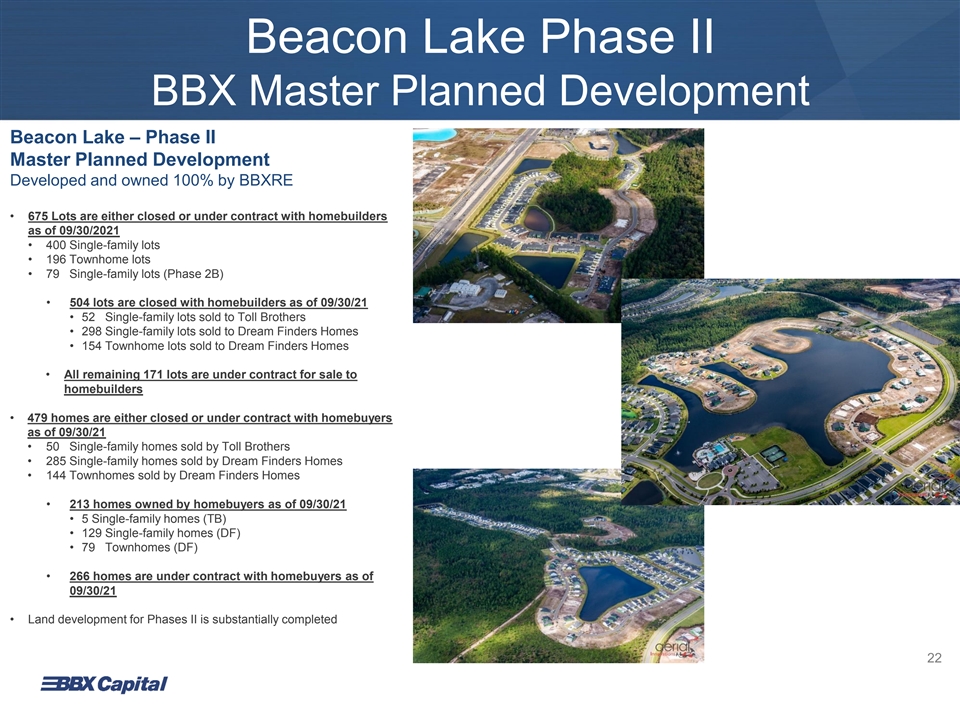

Beacon Lake Phase II BBX Master Planned Development Beacon Lake – Phase II Master Planned Development Developed and owned 100% by BBXRE • 675 Lots are either closed or under contract with homebuilders as of 09/30/2021 • 400 Single-family lots • 196 Townhome lots • 79 Single-family lots (Phase 2B) • 504 lots are closed with homebuilders as of 09/30/21 • 52 Single-family lots sold to Toll Brothers • 298 Single-family lots sold to Dream Finders Homes • 154 Townhome lots sold to Dream Finders Homes • All remaining 171 lots are under contract for sale to homebuilders • 479 homes are either closed or under contract with homebuyers as of 09/30/21 • 50 Single-family homes sold by Toll Brothers • 285 Single-family homes sold by Dream Finders Homes • 144 Townhomes sold by Dream Finders Homes • 213 homes owned by homebuyers as of 09/30/21 • 5 Single-family homes (TB) • 129 Single-family homes (DF) • 79 Townhomes (DF) • 266 homes are under contract with homebuyers as of 09/30/21 • Land development for Phases II is substantially completed 22

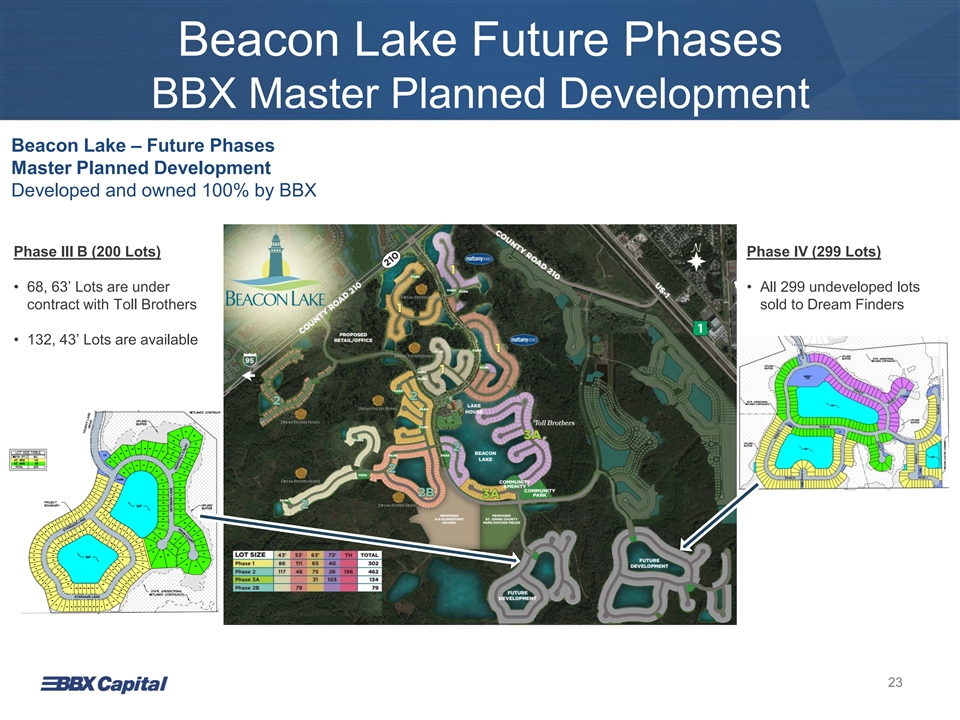

Beacon Lake Future Phases BBX Master Planned Development Beacon Lake – Future Phases Master Planned Development Developed and owned 100% by BBX Phase III B (200 Lots) Phase IV (299 Lots) • 68, 63’ Lots are under • All 299 undeveloped lots contract with Toll Brothers sold to Dream Finders • 132, 43’ Lots are available 23

Beacon Lake BBX Master Planned Development 24

Marbella Marbella Miramar, Florida • Developing 158 homes single family homes • Initial Investment Date – Q2 2015 • JV Partner – Codina-Carr Company • BBX contributed 70% of equity into Joint Venture • Status – Closed on JV and Land in December 2019; Infrastructure work is substantially completed; Vertical Production is underway • All 158 Homes under contract for sale • First home deliveries and closings commenced in Q3 2021 • Homes range in size from 2,588 SF to 3,985 SF • Home prices averaged $785K with several exceeding $1M mark Marbella 25

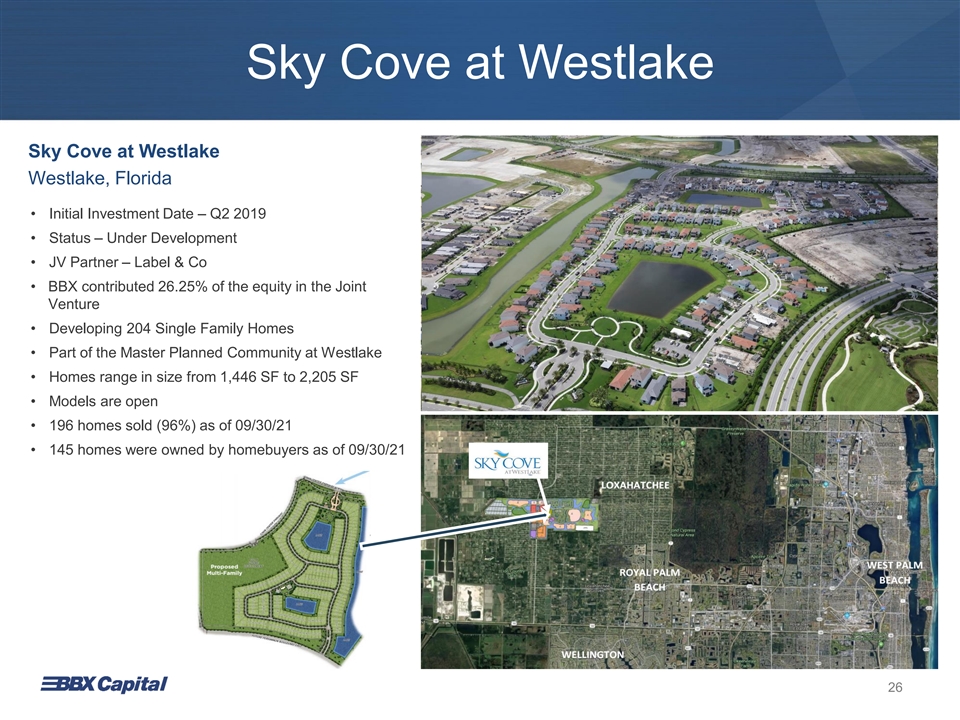

Sky Cove at Westlake Sky Cove at Westlake Westlake, Florida • Initial Investment Date – Q2 2019 • Status – Under Development • JV Partner – Label & Co • BBX contributed 26.25% of the equity in the Joint Venture • Developing 204 Single Family Homes • Part of the Master Planned Community at Westlake • Homes range in size from 1,446 SF to 2,205 SF • Models are open • 196 homes sold (96%) as of 09/30/21 • 145 homes were owned by homebuyers as of 09/30/21 26

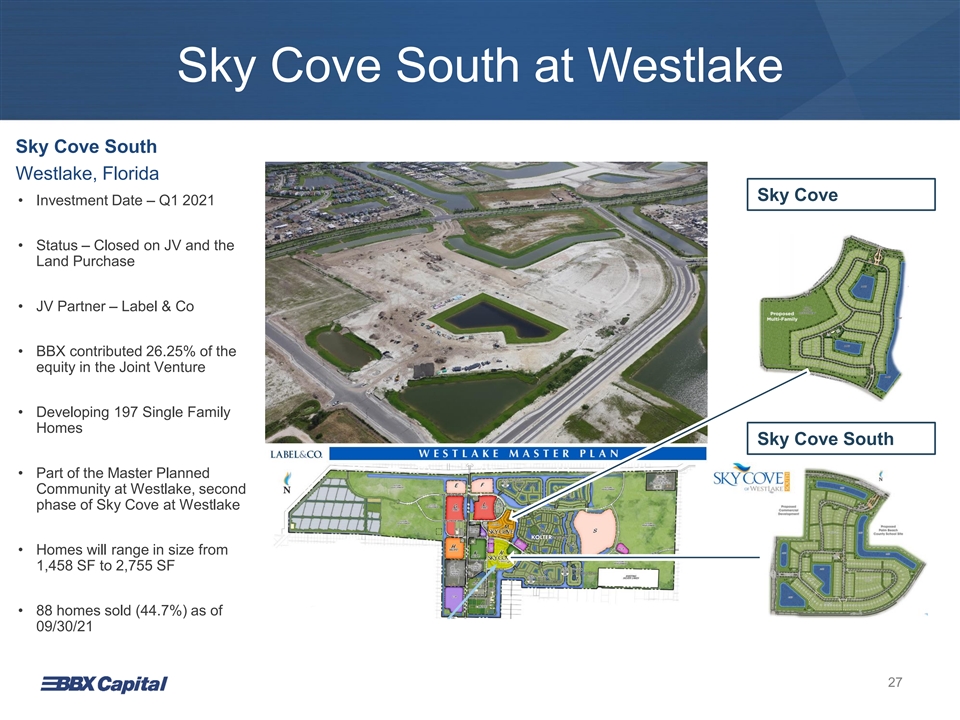

Sky Cove South at Westlake Sky Cove South Westlake, Florida Sky Cove • Investment Date – Q1 2021 • Status – Closed on JV and the Land Purchase • JV Partner – Label & Co • BBX contributed 26.25% of the equity in the Joint Venture • Developing 197 Single Family Homes Sky Cove South • Part of the Master Planned Community at Westlake, second phase of Sky Cove at Westlake • Homes will range in size from 1,458 SF to 2,755 SF • 88 homes sold (44.7%) as of 09/30/21 27

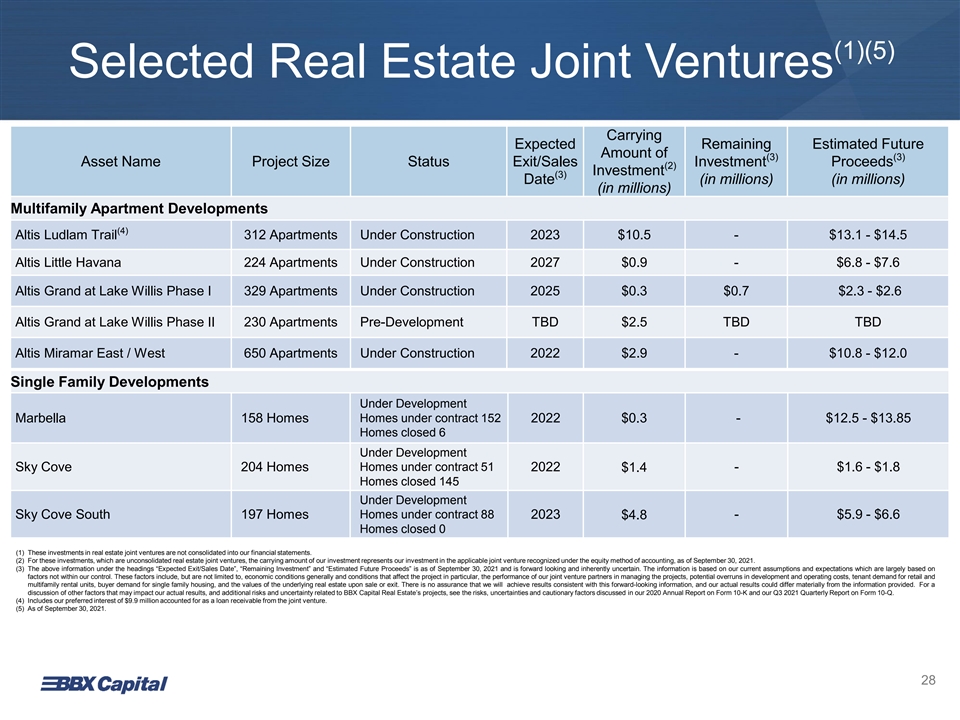

(1)(5) Selected Real Estate Joint Ventures Carrying Expected Remaining Estimated Future Amount of (3) (3) Asset Name Project Size Status Exit/Sales Investment Proceeds (2) Investment (3) Date (in millions) (in millions) (in millions) Multifamily Apartment Developments (4) Altis Ludlam Trail 312 Apartments Under Construction 2023 $10.5 - $13.1 - $14.5 Altis Little Havana 224 Apartments Under Construction 2027 $0.9 - $6.8 - $7.6 Altis Grand at Lake Willis Phase I 329 Apartments Under Construction 2025 $0.3 $0.7 $2.3 - $2.6 Altis Grand at Lake Willis Phase II 230 Apartments Pre-Development TBD $2.5 TBD TBD Altis Miramar East / West 650 Apartments Under Construction 2022 $2.9 - $10.8 - $12.0 Single Family Developments Under Development Marbella 158 Homes Homes under contract 152 2022 $0.3 - $12.5 - $13.85 Homes closed 6 Under Development Homes under contract 51 Sky Cove 204 Homes 2022 $1.4 - $1.6 - $1.8 Homes closed 145 Under Development Sky Cove South 197 Homes Homes under contract 88 2023 - $5.9 - $6.6 $4.8 Homes closed 0 (1) These investments in real estate joint ventures are not consolidated into our financial statements. (2) For these investments, which are unconsolidated real estate joint ventures, the carrying amount of our investment represents our investment in the applicable joint venture recognized under the equity method of accounting, as of September 30, 2021. (3) The above information under the headings “Expected Exit/Sales Date”, “Remaining Investment” and “Estimated Future Proceeds” is as of September 30, 2021 and is forward looking and inherently uncertain. The information is based on our current assumptions and expectations which are largely based on factors not within our control. These factors include, but are not limited to, economic conditions generally and conditions that affect the project in particular, the performance of our joint venture partners in managing the projects, potential overruns in development and operating costs, tenant demand for retail and multifamily rental units, buyer demand for single family housing, and the values of the underlying real estate upon sale or exit. There is no assurance that we will achieve results consistent with this forward-looking information, and our actual results could differ materially from the information provided. For a discussion of other factors that may impact our actual results, and additional risks and uncertainty related to BBX Capital Real Estate’s projects, see the risks, uncertainties and cautionary factors discussed in our 2020 Annual Report on Form 10-K and our Q3 2021 Quarterly Report on Form 10-Q. (4) Includes our preferred interest of $9.9 million accounted for as a loan receivable from the joint venture. (5) As of September 30, 2021. 28

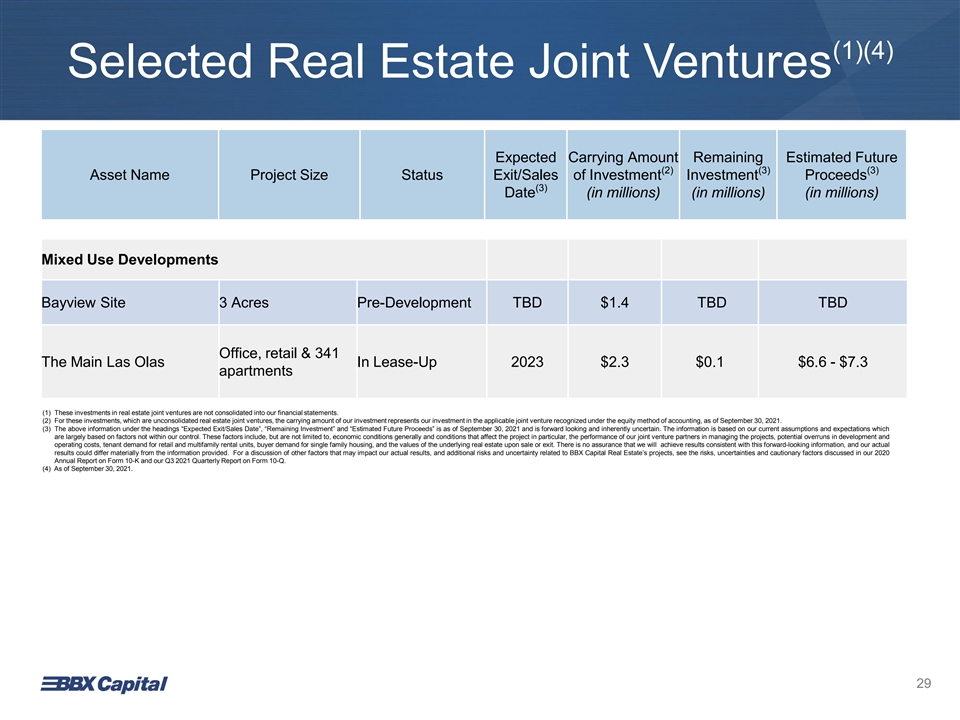

(1)(4) Selected Real Estate Joint Ventures Expected Carrying Amount Remaining Estimated Future (2) (3) (3) Asset Name Project Size Status Exit/Sales of Investment Investment Proceeds (3) Date (in millions) (in millions) (in millions) Mixed Use Developments Bayview Site 3 Acres Pre-Development TBD $1.4 TBD TBD Office, retail & 341 The Main Las Olas In Lease-Up 2023 $2.3 $0.1 $6.6 - $7.3 apartments (1) These investments in real estate joint ventures are not consolidated into our financial statements. (2) For these investments, which are unconsolidated real estate joint ventures, the carrying amount of our investment represents our investment in the applicable joint venture recognized under the equity method of accounting, as of September 30, 2021. (3) The above information under the headings “Expected Exit/Sales Date”, “Remaining Investment” and “Estimated Future Proceeds” is as of September 30, 2021 and is forward looking and inherently uncertain. The information is based on our current assumptions and expectations which are largely based on factors not within our control. These factors include, but are not limited to, economic conditions generally and conditions that affect the project in particular, the performance of our joint venture partners in managing the projects, potential overruns in development and operating costs, tenant demand for retail and multifamily rental units, buyer demand for single family housing, and the values of the underlying real estate upon sale or exit. There is no assurance that we will achieve results consistent with this forward-looking information, and our actual results could differ materially from the information provided. For a discussion of other factors that may impact our actual results, and additional risks and uncertainty related to BBX Capital Real Estate’s projects, see the risks, uncertainties and cautionary factors discussed in our 2020 Annual Report on Form 10-K and our Q3 2021 Quarterly Report on Form 10-Q. (4) As of September 30, 2021. 29

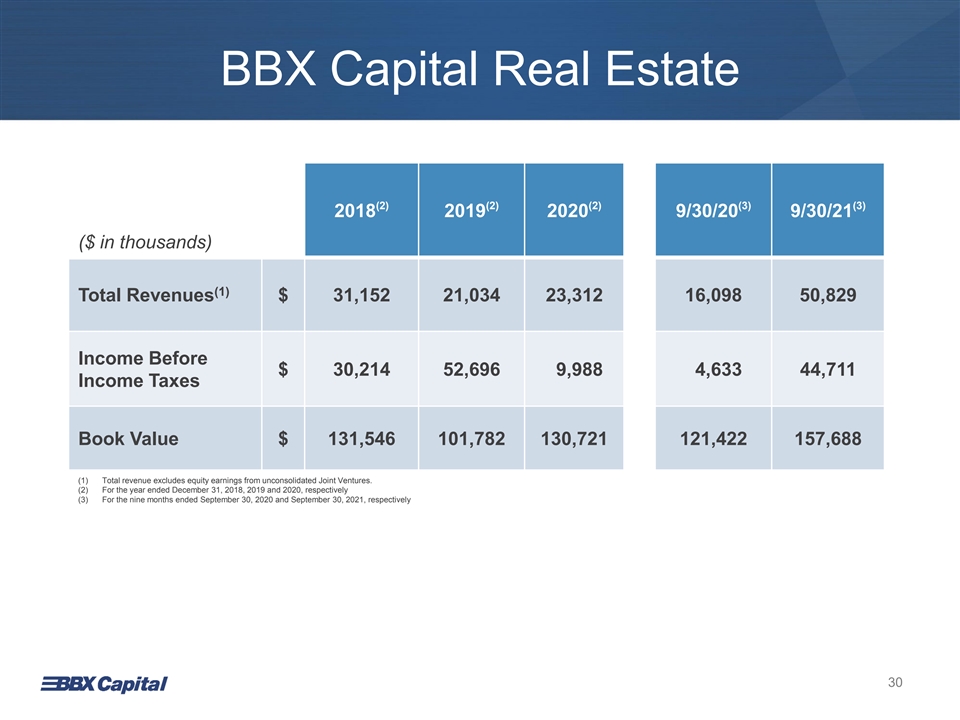

BBX Capital Real Estate (2) (2) (2) (3) (3) 2018 2019 2020 9/30/20 9/30/21 ($ in thousands) (1) Total Revenues $ 31,152 21,034 23,312 16,098 50,829 Income Before $ 30,214 52,696 9,988 4,633 44,711 Income Taxes Book Value $ 131,546 101,782 130,721 121,422 157,688 (1) Total revenue excludes equity earnings from unconsolidated Joint Ventures. (2) For the year ended December 31, 2018, 2019 and 2020, respectively (3) For the nine months ended September 30, 2020 and September 30, 2021, respectively 30

Principal Holdings 1 2 3 • IT’SUGAR • Acquisition, • Designer, • Hoffman’s development, manufacturer and Chocolates and management distributor of: of real estate and ➢ Sliding doors • Las Olas investments in ➢ Door systems Confections real estate joint and hardware ventures➢ Home décor products 31

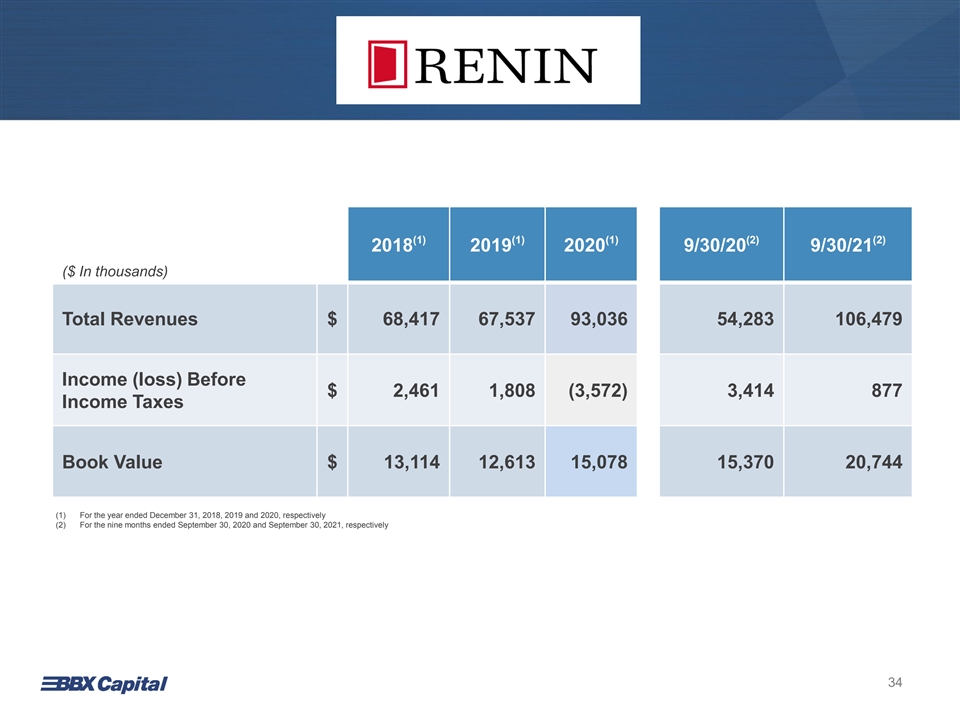

Renin is engaged in the design, manufacture, and distribution of sliding doors, door systems and hardware and home décor products. Renin, which is headquartered in Canada has three manufacturing and distribution facilities in the United States and Canada. In October 2020, Renin acquired Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts, primarily sold through various big box retailers in the United States and Canada. Renin had total assets of $107.2 million as of September 30, 2021. 32

In October 2020, Renin acquired substantially all of the assets and assumed certain of the liabilities of Colonial Elegance. Headquartered in Montreal, Canada, Colonial Elegance is a supplier and distributor of building products, including barn doors, closet doors, stair parts, jackpost covers, columns, and balustrades. Colonial Elegance’s customers include big box retailers in the United States and Canada which we believe will be complementary to and expand Renin’s existing customer base. 33

(1) (1) (1) (2) (2) 2018 2019 2020 9/30/20 9/30/21 ($ In thousands) Total Revenues $ 68,417 67,537 93,036 54,283 106,479 Income (loss) Before $ 2,461 1,808 (3,572) 3,414 877 Income Taxes Book Value $ 13,114 12,613 15,078 15,370 20,744 (1) For the year ended December 31, 2018, 2019 and 2020, respectively (2) For the nine months ended September 30, 2020 and September 30, 2021, respectively 34

Principal Holdings 1 2 3 • Acquisition, • Designer, • IT’SUGAR development, manufacturer and • Hoffman’s and management distributor of: Chocolates ➢ Sliding doors • Las Olas of real estate and investments in ➢ Door systems Confections real estate joint and hardware ventures➢ Home décor products 35

BBX Sweet Holdings • BBX Sweet Holdings is engaged in the ownership and management of operating businesses in the confectionery industry. BBX Sweet Holdings had total assets of $140.2 million as of September 30, 2021. •IT’SUGAR is one of the largest specialty candy retailers in the United States, with a current footprint of approximately 100 “retailtainment” locations throughout the country. IT’SUGAR’s sales include bulk candy, candy in giant packaging, and licensed and novelty items. •Hoffman’s Chocolates is a retailer of gourmet chocolates in retail locations in South Florida. • Las Olas Confections and Snacks is a manufacturer and wholesaler of chocolate and other confectionery products. 36

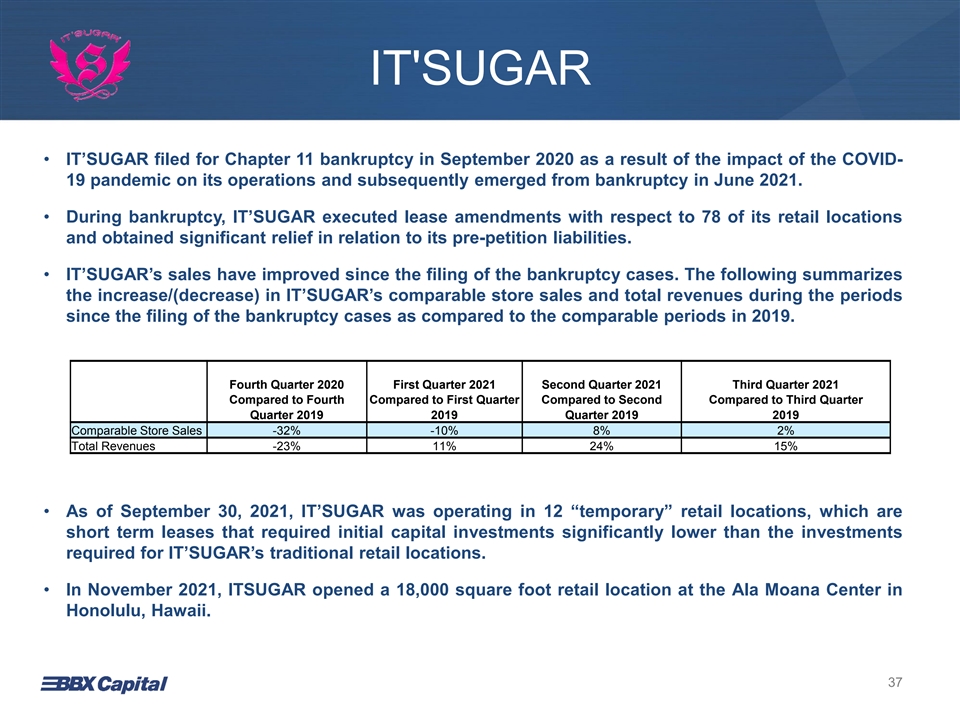

IT'SUGAR IT'SUGAR •IT’SUGAR filed for Chapter 11 bankruptcy in September 2020 as a result of the impact of the COVID- 19 pandemic on its operations and subsequently emerged from bankruptcy in June 2021. • During bankruptcy,IT’SUGAR executed lease amendments with respect to 78 of its retail locations and obtained significant relief in relation to its pre-petition liabilities. •IT’SUGAR’s sales have improved since the filing of the bankruptcy cases. The following summarizes the increase/(decrease) inIT’SUGAR’s comparable store sales and total revenues during the periods since the filing of the bankruptcy cases as compared to the comparable periods in 2019. Fourth Quarter 2020 First Quarter 2021 Second Quarter 2021 Third Quarter 2021 Compared to Fourth Compared to First Quarter Compared to Second Compared to Third Quarter Quarter 2019 2019 Quarter 2019 2019 Comparable Store Sales -32% -10% 8% 2% Total Revenues -23% 11% 24% 15% • As of September 30, 2021,IT’SUGAR was operating in 12“temporary” retail locations, which are short term leases that required initial capital investments significantly lower than the investments required forIT’SUGAR’s traditional retail locations. • In November 2021, ITSUGAR opened a 18,000 square foot retail location at the Ala Moana Center in Honolulu, Hawaii. 37

IT’SUGAR Las Vegas Opened May 2019 38

IT’SUGAR American Dream Rutherford, NJ 39

IT’SUGAR American Dream Oreo Cafe Rutherford, NJ 40

IT’SUGAR Hawaii Opened November 2021 ALA MOANA - HAWAII 41

Principal Holdings 1 2 3 • Designer, • IT’SUGAR • Acquisition, manufacturer and • Hoffman’s development, distributor of: Chocolates and management ➢ Sliding doors • Las Olas of real estate and ➢ Door systems Confections investments in and hardware real estate joint ➢ Home décor ventures products 42

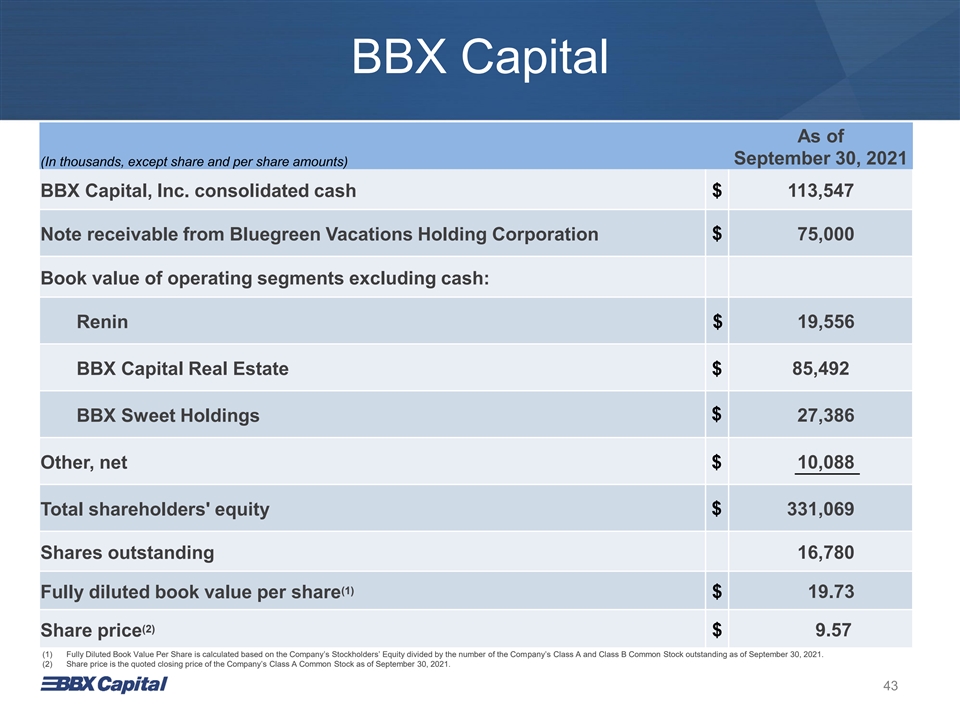

BBX Capital As of September 30, 2021 (In thousands, except share and per share amounts) BBX Capital, Inc. consolidated cash $ 113,547 $ 75,000 Note receivable from Bluegreen Vacations Holding Corporation Book value of operating segments excluding cash: Renin $ 19,556 BBX Capital Real Estate $ 85,492 $ 27,386 BBX Sweet Holdings Other, net $ 10,088 $ Total shareholders' equity 331,069 Shares outstanding 16,780 (1) Fully diluted book value per share $ 19.73 (2) $ 9.57 Share price (1) Fully Diluted Book Value Per Share is calculated based on the Company’s Stockholders’ Equity divided by the number of the Company’s Class A and Class B Common Stock outstanding as of September 30, 2021. (2) Share price is the quoted closing price of the Company’s Class A Common Stock as of September 30, 2021. 43

Thank You! For additional information, please contact: Leo Hinkley, Investor Relations Officer, Managing Director Telephone: 954-940-5300 Email: InvestorRelations@BBXCapital.com December 2021